Summer 2019

In this issue…

- Message from the Chair

- 2019 Benefit Verification process update: Thank you, retirees!

- COLA included in Governor’s FY2020 budget

- MTRS celebrates 105 years of serving Massachusetts educators

- Our system: Who we are, and where we stand

- Legislative update: MTRS files bill to prohibit payment of pensions to teachers convicted of child pornography charges

- News briefs

Message from the Chair

We proudly celebrate 105 years of service to Massachusetts educators

- Our total membership has grown from just over 7,500 to more than 159,000, and ours is now the largest of the Commonwealth’s 104 public retirement systems.

- As the state’s population has multiplied and the average life expectancy has risen—for Massachusetts residents in 2016, it was 80 years and 8 months—the ratio of active members to benefit recipients has decreased. In 1914 there were 42 teachers for every one retiree; in 2004, there were five active members for every two retirees. Today, the ratio is just under three active members for every two benefit recipients.

This maturing of our plan has created funding challenges. As you know, the financial health of our system depends on three sources of income: employee contributions, employer contributions (which are paid by the Commonwealth on behalf of local school districts), and investment income. Our investment assets—now more than $29 billion—are managed by the state’s Pension Reserves Investment Management (PRIM) Board, which has been long recognized as one of the nation’s top public sector institutional investors. As noted in this newsletter, PRIM is in the running for “Public Plan of the Year” and we congratulate them on their nomination—the fourth in as many years.

Although many things have changed since 1914, one thing has remained constant: our commitment to providing you, the educators of Massachusetts, with quality service and retirement security. We look forward to serving you for many years to come.

My best wishes to you and your families for a healthy and happy summer,

Jeff Wulfson, Deputy Commissioner of the Department of Elementary and Secondary Education, Chair of the Massachusetts Teachers’ Retirement Board

2019 Benefit Verification process update:

Thank you, retirees!

As we go to press, 98% of you have already returned your forms

As most of you know, every other year, we are required to conduct a process by which we verify all benefit recipients’ continued eligibility to receive payments.

This past January, we mailed blue and yellow Benefit Verification forms to our over 66,000 members who were receiving a monthly benefit as of December 31, 2018. We are very happy to report that, as we go to press, we have received nearly all of these forms—a return rate of 98% to date. Thank you for your cooperation!

Benefit recipients who do not submit completed forms by the beginning of July will have their MTRS benefit allowances interrupted, beginning with their July payments, and their benefits will not be reinstated until they complete and return their Benefit Verification forms.

What is the purpose of the Benefit Verification process?

While we know that this might seem like a tedious and bothersome task for some of you, it is a very helpful and serious process for us. Most importantly, it ensures the protection of the retirement system by verifying that we are paying benefits to you, the people who earned them. In order to ensure that benefits are still being paid to the correct individuals, by law, we must confirm that the intended recipients are still alive and, therefore, eligible to receive benefits.

In rare cases—none in recent years—we have discovered that, after a retiree has died, a family member has continued to collect benefits even though that family member is not eligible for any survivor benefits.

As an added benefit, this process helps us identify retirees who are entitled to an increase in their benefits—specifically, members who retired under Option C, whose Option C beneficiary has predeceased them, but who have not yet notified us of their beneficiary’s passing. (Under Option C, if your survivor predeceases you, you are to notify the MTRS because you are then entitled to have your payment “pop up” to the higher amount that you would have received under Option A. )

In addition to the Benefit Verification process, what other methods does the MTRS use to prevent the fraudulent collection of benefits after a retiree’s death?

For many years, we have utilized a variety of verification methods, such as deceased Social Security number match services and tracking of tax documents. Although these methods have been largely successful, the MTRS has uncovered a small number of instances where a family member of a deceased retiree, who is not eligible for any survivor benefits, has continued to collect benefits after the retiree’s death. In instances of pension fraud, we have worked with the Attorney General’s office to prosecute the appropriate individuals.

If the MTRS isn’t notified in a timely manner of a retiree’s death and an overpayment occurs, what do you do to collect the overpayment?

In the event that we are not notified in a timely manner of a retiree’s death, or the retiree’s death occurs after our mid-month processing date and we are unable to stop their benefit payment, an overpayment may occur. When this happens, it is our responsibility to recover any benefits paid after the date of death.

In these cases, we understand that it may be a difficult time, and we work closely with our retiree’s survivors, and his or her estate, to explain the steps that we need to take to reclaim the overpayment, or that they need to take to repay it.

In brief:

- Shortly after being notified of a benefit recipient’s death, we send a notice to the recipient’s bank, requesting the reclamation of the overpaid funds. We also mail a copy to the estate’s administrator or other contact person.

- If the recipient’s bank does not return the full amount of overpaid funds to the MTRS within three weeks, or if the funds recovered do not eliminate the debt, we then send a billing letter to the surviving spouse or contact person (or, if there is no contact person, to the estate), notifying the estate of the remaining debt, how to pay the debt, and requesting payment within 30 days.

In most cases, the recipient’s bank or survivor returns the overpaid funds to the MTRS, and the retiree’s account is closed.

However, if the amount is not repaid, the MTRS will pursue several options to recover the funds. The Board may:

- refer the debt to a collection agency,

- report it to the Department of Revenue so that any funds payable to the estate may be intercepted, or

- deduct the remaining debt from the surviving spouse’s monthly benefit if he or she is also an MTRS retiree, and our records indicate that the retiree and the surviving spouse were married and living together at the time of the retiree’s death.

We understand that it can be an uncomfortable subject to broach, but have the talk now: Advise your survivors to notify us as soon as possible after your passing to notify us, so that we may process any benefits that may be payable, and to help prevent the potential issues involved with unnecessary overpayments. For additional info, see our web page on reporting the death of a benefit recipient.

COLA included in FY2020 budget proposals

If approved, would allow a maximum annual increase of $390, effective July 1st

The current FY2020 budget proposals from the Governor and the Legislature all include a recommended cost-of-living adjustment (COLA) of 3% on the first $13,000 of eligible MTRS retirees’ benefits, for a maximum annual increase of $390 for the fiscal year beginning July 1, 2019. To be eligible to receive this COLA, you must have retired on or before June 30, 2018.

Although the Consumer Price Index for the year ended December 31, 2018 was 2.8%, the Legislature and Governor may still allow an increase up to 3% on the base amount in accordance with M.G.L. Chapter 32. In previous years (including last year) when the CPI has been less than 3%, Governors and the Legislature have approved COLAs of 3%. Before the MTRS can pay any COLA, however, the FY2020 budget must first be finalized. The increase, if approved, will take effect in our retirees’ July benefit payments.

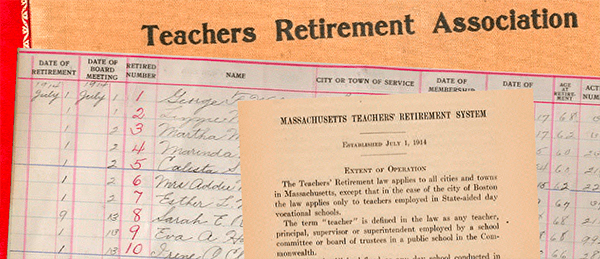

MTRS celebrates 105 years of serving MA educators!

This year, we proudly mark 105 years of service to Massachusetts educators

Over a century later, those words still ring true. We may have had different names over the years, but our commitment to educators remains unchanged.

The Teachers’ Retirement Association was established as part of Chapter 832 of the Acts of 1913, signed on June 19, 1913. The legislation had a tumultuous history: in 1911, a bill asking for enactment of a teachers’ retirement system failed to pass. The Legislature instead passed a resolve asking the Board of Education to decide whether such a system would work. In response, the Board presented recommendations with Chapter 832, the bill that created the MTRS, effective July 1, 1914.

Over the past 105 years, the MTRS has served countless numbers of retirees, active members and their families. We look forward to continuing a tradition of excellence in helping our members achieve a rewarding and enjoyable retirement for many years to come!

For more MTRS history, see our milestones over the years.

The MTRS: Then and now |

||

1914 |

Now |

|

| Retirees and survivors | 176 | 66,078 |

| Active members | 7,336 | 93,119 |

| Contribution rate | 5% | 11% |

| Average age of benefit recipient | 67 | 72.6 |

| Average annual benefit | $380* | $44,389 |

*For those of you wondering, this is equal to $9,606 today

Our system: Who we are, and where we stand

Unless otherwise noted, figures are as of January 1, 2018. Source: Public Employee Retirement Administration Commission’s 2018 Actuarial Valuation of the Massachusetts Teachers’ Retirement System. Our next valuation, effective 1/1/2019, is to be expected to be completed by the fall of 2019.

A profile of our membership…

Active members

- Population 93,119

- Average salary $73,336

- Average age 43.6

- Average service 13.1 years

- Annual member compensation $6.8 billion

- Annual employee contributions $692 million

Retirees and survivors

- Population 66,078

- Average annual benefit $44,389

- Average age 72.6

- Total benefits paid $2.93 billion

…and our funding status

- Percent funded 52.4%

- Unfunded actuarial liability $24.6 billion

- Year fully funded (target) 2036

The Teachers’ Retirement System’s assets are invested by the Pension Reserves Investment Management (PRIM) Board. As of April 30, 2019, the PRIT Fund’s assets were invested as follows:

- Global equity 43.5%

- Core fixed income 13.1%

- Private equity 10.8%

- Value-added fixed income 8.1%

- Real estate 9.5%

- Timberland 3.8%

- Portfolio completion strategies 10.0%

Hedge funds, risk premia, real assets and equity hedge strategies - Cash overlay 0.9%

For more information about the PRIM Board and the PRIT Fund, visit PRIM’s website.

PRIM Board has been nominated for “Public Plan of the Year” for a fourth year running; previously awarded in 2016

PRIM has been nominated for a fourth year running for “Public Plan of the Year” at Institutional Investor’s 17th annual Hedge Fund Industry Awards, to be held in New York on June 27, 2019. PRIM previously won this award in 2016.

PRIM continues to receive recognition for its innovative hedge fund program that produces very high risk-adjusted returns while saving approximately $100 million annually on hedge funds fees. PRIM led the industry with the use of direct hedge fund investments replacing fund-of-funds, and also led in its pursuit of separately managed accounts (SMAs), which give PRIM complete transparency, more control and lower fees than commingled funds that are the norm for most investors. SMAs now comprise more than 75% of hedge fund assets. PRIM’s SMA program and—more recently—its Emerging Manager Program, are being emulated by peers across the globe.

Funding status

PRIT core fund performance

MTRS asset value

Legislative update

MTRS files legislation to prohibit payment of pensions to members convicted of child

pornography charges

The Massachusetts retirement statute provides that any public employee convicted of a crime “involving violation of the laws applicable to his office or position” forfeits his or her retirement allowance, and is entitled only to a return of his or her contributions without interest.

The Massachusetts Teachers’ Retirement Board believes that in the very rare instance when an educator is convicted of the possession of child pornography or other sex crimes against children, even if “off duty,” that educator should forfeit his or her pension because such crimes are repugnant to the special trust and duty inherent in the position of an educator.

Unfortunately, the Supreme Judicial Court disagreed with the Board in Garney v. MTRS, 469 Mass. 384 (2014). Although the Court readily acknowledged that teachers are charged with a “special public trust,” and that crimes such as possession of child pornography may be sufficient to dismiss a teacher from employment, the Court held that a conviction for the private possession of child pornography did not sufficiently “involve” the position of teacher so as to forfeit a teacher’s retirement allowance.

As it did in 2014 and 2016, the Board has again filed legislation to make clear that certain offenses, namely possession of child pornography as well as others that require registration as a “sex offender,” when committed against children, are so contrary to the role of educating children that convictions of these crimes are indeed “fundamental” to the job of an educator.

Our current filing—H.17, AN ACT RELATIVE TO PENSION FORFEITURE—would make substantive and technical changes to the retirement statutes regarding the forfeiture of a Massachusetts public employee retirement benefit. Specifically, this legislation would:

- redefine the phrase “criminal offense involving violation of the laws applicable to his office or position,” in the case of a member whose primary job responsibilities involve contact with children or any member of the Massachusetts Teachers’ Retirement System or a teacher who is a member of the Boston Retirement System, to include possession of child pornography under G.L. c. 272, § 29C, as well as other sex offenses involving children;

- restrict forfeitures to felony convictions;

- allow for an “innocent beneficiary” named as an Option C beneficiary to collect the Option C survivor benefit notwithstanding the member’s forfeited benefit; and,

- continue to allow total forfeiture, but also allow retirement boards the option of a tiered reduction in pension benefits depending on the severity of the crime.

The Board is aware that the vast, vast majority of the educators in the Commonwealth uphold this special public trust and are no doubt appalled at the notion that a small number do not. Although this affects very few of our members, the Board feels that even one case is unacceptable and, for that reason, has filed this legislation.

News briefs