During your career as an eligible MTRS member it may be possible that your contribution rate will change due to certain circumstances.

How much am I required to contribute?

You are required to contribute a set percentage of your salary through regular payroll deductions.

Your contribution rate is established by the Commonwealth’s retirement law (Chapter 32 of the Massachusetts General Laws) and is determined by the date on which you most recently became eligible for membership in a Massachusetts contributory retirement system and from which you continuously maintained your funds on account. Most of our members will establish membership in a contributory retirement system on the date they start working as a public employee in Massachusetts.

Please visit our Your membership page for more details, including a chart regarding all of the different contribution rates for members in our system.

How can I check my contribution rate?

Look at your pay stub. Divide the amount of your retirement withholding by your gross income, and then refer to the contribution chart. For example, if your enrollment date is January 2, 1979 and your salary is $35,000, your total contribution would be 7% of $35,000 plus 2% of $5,000. The 2% contribution does not apply to RetirementPlus participants.

If your contribution rate is not correct, confirm your calculation with your payroll office and then contact the MTRS. Note: If the 2% contribution also applies, be sure it appears on your pay stub.

For more info, watch this section of our RetirementPlus special election seminar, recorded on 02/23/2023 (link will open in YouTube).

- Why is the “9+2” regular contribution rate not the same as the 11% RetirementPlus contribution rate?

- How is the additional “plus” 2% on earnings over $30,000/year calculated?

- What happens if I am contributing or have contributed at “9+2,” but I should be at a flat 11% because I chose to participate in RetirementPlus?

- How much will I owe to make my account whole?

- What if I choose not to participate in RetirementPlus and have contributed at 11%?

Why is the “9+2” regular contribution rate not the same as the 11% RetirementPlus contribution rate?

If you are not participating in RetirementPlus, you are contributing at one of the lower contribution rates within the grid above—most likely the 9% flat rate on your entire salary, with an additional 2% on earnings over $30,000. This rate is called “9+2” or “9 and 2.” Pay stubs may also label these additional 2% contributions as “RET2,” “ADDL2%,” “PLUS2,” or some variation of these examples. Some members may also hear or see the word “plus” and believe this means RetirementPlus.

The differences between these two rates can be confusing because the lower “9+2” rate is a common rate established at other Massachusetts contributory retirement systems, one could assume that 9% plus 2% on earnings over $30,000/year adds up to a flat 11%, but that is not the case. It is important to remember that the additional 2% withholding is only on a portion of your salary, not the entire amount.

For example: Joe Teacher recently transferred into the MTRS from another Massachusetts contributory retirement system.

R+ Flat 11% Contribution Rate

If Joe decides to participate in R+, his bi-weekly contribution would be:

$2,230.77 x 11% = $245.38

“9+2” Contribution Rate

If Joe decides to opt out of R+, his bi-weekly contribution would be:

$2,230.77 x 9% = $200.77

2% contributions on earnings over $30,000: $21.54$200.77 + $21.54 = $222.31 (total “9+2”)

The difference between both contribution rates is $23.07 ($245.38 – $222.31). The annual difference is $600 ($23.07 x 26). The difference per paycheck will vary depending on the number of paychecks you receive in a year; however, the annual difference between 11% and “9+2” will always be $600/year, unless something abnormal occurs with your pay or you make less than $30,000 in one calendar year.

How is the additional “plus” 2% on earnings over $30,000/year calculated?

According to PERAC memo #43 from 1999, the additional 2% must be calculated on a per pay period basis. Rather than subtracting $30,000 from your entire salary, it must be done incrementally from each pay throughout the year.

First, you must figure out the number of times you are paid each year. Many members receive their pay over 26 pay periods; therefore, we will use this in our calculation example.

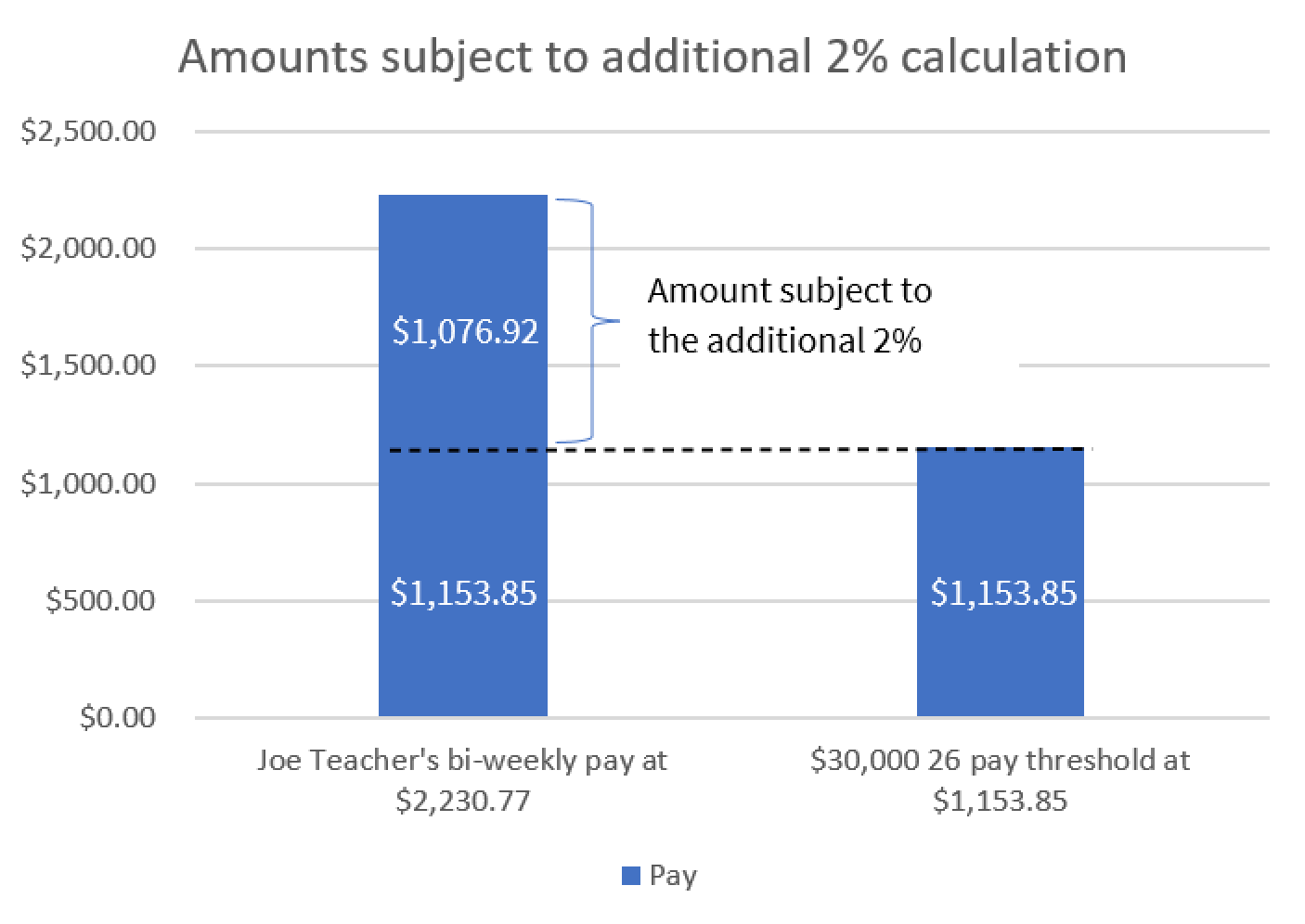

If Joe Teacher makes $58,000 per school year and is paid bi-weekly over 26 pays, his gross bi-weekly pay is $2,230.77, the portion of which “above” $30,000 is $1,076.92 ($30,000/26=$1,153.85; $2,230.77-$1,153.85=$1,076.92)

The 2% is then withheld from $1,076.92. Joe’s 2% contribution is $21.54 ($1,076.92 x 2%).

For more information on the difference between 11% and 9%+2% contribution rates, watch this section of our RetirementPlus special election seminar, recorded on 02/23/2023 (link will open in YouTube).

What happens if I am contributing or have contributed at “9+2,” but I should be at a flat 11% because I chose to participate in RetirementPlus?

If you elected to participate in RetirementPlus and your school district is currently withholding at a rate lower than 11%, your rate will need to be changed immediately. As a reminder, someone who chooses to participate in RetirementPlus will owe the difference between 11% and any lower rate. All shortages in your account, going back to your MTRS membership date, must be paid to make your account whole.

You will eventually receive these contributions back as part of your future retirement benefit; however, it is important for the system to invest these funds to provide you and all our members with a lifetime benefit.

How much will I owe to make my account whole?

This amount may vary; however, as stated above, the amount is generally $600 per year for members contributing at “9+2”. You will owe the difference going back to when you first became a member of the MTRS. If you owe 10 years’ worth of contributions, you will owe approximately $6,000 ($600/year x 10 years). If you were at a rate lower than “9+2”, you would owe significantly more because the difference between 11% and an even lower rate will produce a higher amount.

The final amount will be calculated once your rate has been changed to 11% and posted to your annuity savings account.

What if I choose not to participate in RetirementPlus and have contributed at 11%?

If you have contributed at 11% and choose not to participate in RetirementPlus, the MTRS will ensure that you are no longer contributing at 11% and calculate what you should have contributed to the MTRS at your lower rate, making your account whole and returning the principal amount to you. When feasible, the IRS requires these contributions to be returned as a payroll credit or as an MTRS refund directly to the member. The refund will have 10% withheld for federal taxes, and you will receive a 1099-R at the beginning of the following year. These refunds are not eligible for rollovers to other financial institutions.

Interest earned on these contributions will remain in your MTRS annuity savings account and be used to fund your future benefit. In rare circumstances, some members may owe contributions to make their account whole due to other shortages.

- Why is my rate being changed?

- Why was the incorrect rate taken?

- How is my correct contribution rate determined?

- Why am I not in RetirementPlus (R+) at 11%? I thought I was automatically included.

- Can I participate in R+ if I did not submit an election form during the original election in 2001?

- How long will it take to get my refund/invoice?

- How will my refund/invoice be calculated?

Why is my rate being changed?

We have audited your account and have determined that you were contributing at an incorrect rate.

Why was the incorrect rate taken?

There could be several different reasons, including but not limited to:

- Incomplete enrollment, resulting in your Employer and/or the MTRS not knowing about prior public service

- Lack of communication between employee/school district/MTRS

- Clerical/payroll software errors

- RetirementPlus elections

How is my correct contribution rate determined?

MTRS member contribution rates are established pursuant to M.G.L. c. 32, §22 and is based on your original start date in a MA public contributory retirement system and your RetirementPlus status.

For more information on contribution rates, visit the Your membership section of our website: https://mtrs.state.ma.us/members/#your-membership

Why am I not in RetirementPlus (R+) at 11%? I thought I was automatically included.

You are most likely not participating because you elected not to participate, or the MTRS did not receive a valid election prior to June 30th, 2023.

For more information, please visit the RetirementPlus section of our website: https://mtrs.state.ma.us/members/retirementplus/

Can I participate in R+ if I did not submit an election form during the original election in 2001?

No. If the MTRS mailed your election form to the address on file during your election period and you did not respond, we cannot change your status.

How long will it take to get my refund/invoice?

Once your rate has been changed, we must wait for your Employer to submit the monthly deduction report with the rate correction before we can calculate the final refund/invoice amount. Deduction reports are due the 10th of the following month (e.g., April’s report is due May 10th). Some reports may take longer to rectify due to district size, and complexity of reporting issues. Some calculations may also be more complex than others, so it takes time for us to calculate your refund/invoice. Please check with your Employer for a status of the rate change, along with the completion status of the monthly deduction reports.

WE WILL CONTACT YOU once a determination has been made on your account. Please refrain from asking for status updates, as we must wait for the correct contributions to post to your account.

How will my refund/invoice be calculated?

Once your correct contribution rate is verified and successfully posted to your account, the MTRS will calculate the difference between your correct contribution rate and the actual deductions that were withheld. The final total may result in a refund or invoice that will make your account whole. All invoices must be paid in full prior to retirement.

- Why am I receiving this refund?

- Will this refund change or reduce my retirement benefit?

- How was my refund calculated?

- Will I receive interest on my excess contribution refund?

- Do I need to pay taxes on my refund?

- Can I roll this money over to another pre-tax account?

- Can you return the money via direct deposit?

- Can I spend this money?

Why am I receiving this refund?

You are receiving this refund because your Employer sent excess contributions to the MTRS beyond what you were legally required to contribute.

Will this refund change or reduce my retirement benefit?

No. This refund will not change or reduce any future retirement benefits.

How was my refund calculated?

The MTRS calculated the difference between the legally required contribution rate and the actual deductions that were withheld.

Will I receive interest on my excess contribution refund?

Under Massachusetts law, interest is not included in an excess contribution refund. However, the interest earned from the excess contributions will remain in your annuity savings account and would be included should you withdraw your annuity account or transfer to another MA retirement system if you leave MTRS eligible service.

Do I need to pay taxes on my refund?

Yes. IRS Code Section 3405 applies and 10% federal taxes must be withheld on contributions received after January 1, 1988. You will receive a 1099R for the calendar year in which you received the payment. For questions regarding state taxes and other withholdings, please contact your district’s payroll officer. For any additional questions you have regarding how this payment affects your taxes, please contact your tax advisor or the IRS.

Can I roll this money over to another pre-tax account?

No. The exclusive benefit and anti-diversion rules under IRS Code Section 401(a)(2) prohibit a transfer.

Can you return the money via direct deposit?

No. Our computer system does not have the capability to return the funds via direct deposit.

Can I spend this money?

Yes. These are wages you would have received as gross earnings had no error occurred, and it is your money. It will not change your current/future retirement benefit.

- What are my payment options?

- Why am I receiving this invoice?

- How was my invoice calculated?

- Do I have to pay interest on my invoice?

- What happens with the interest I have paid for this invoice?

- What happens if I choose not to pay my invoice?

What are my payment options?

If you owe money to the MTRS to make your account whole, you have the following options:

- Pay in full by check

- Transfer money over from a qualified supplemental retirement plan

- Trust-to-Trust Transfer Acknowledgment Form for a plan that you are still actively contributing to

- Direct Rollover Acknowledgment Form for a plan that you have stopped contributing to

- A five-year installment plan if your amount is $1,000 or higher. This plan will include interest at one half of the actuarial rate of return, which is currently at 3.5% (actuarial rate is currently set at 7% for CY2023).

If you choose not to pay your invoice, interest will accrue on the principal amount at the buyback rate, starting on the day of your first due date (currently 90 days from the MTRS mailing out your invoice) until the time of payment. This must be paid in full prior to your retirement date.

Why am I receiving this invoice?

You are receiving this invoice because your Employer withheld a lower contribution rate than is required for RetirementPlus, resulting in a shortage in your MTRS annuity savings account.

How was my invoice calculated?

The MTRS calculated the difference between the legally required contribution rate for Retirement Plus (11%) and the actual deductions that were withheld. All invoices, including any future interest charges, must be paid in full prior to retirement to make your account whole.

Do I have to pay interest on my invoice?

You have a one-time grace period of 90 days where no interest will be charged. If the invoice is not paid within the first 90 days, interest at the buyback rate will start to accrue.

If you request an updated invoice, the interest will be back-dated to the original invoice due date.

What happens with the interest I have paid for this invoice?

The interest is added to and stays in your MTRS annuity savings account.

What happens if I choose not to pay my invoice?

If you choose not to pay your invoice and then apply for retirement benefits in the future, you will not receive your benefit until the amount owed (includes Mandatory participants of R+), plus any accrued interest has been paid in full.

If you made an election to participate in R+, or defaulted into R+ after a service transfer from another MA retirement system and meet the 30 year service requirement for R+ at the time of retirement, you will default to the “regular” retirement benefit. Any contributions made at 11% will remain in your annuity account if the invoice amount plus any accrued interest, remains unpaid.