- I am participating in RetirementPlus. What does this mean for my retirement benefit?

- I am not participating in RetirementPlus because I elected not to participate (or I didn’t submit a timely election form). Can I elect in now?

- How do I know if I am subject to RetirementPlus?

- How can I check my contribution rate?

- Why is the “9+2” regular contribution rate not the same as the 11% RetirementPlus contribution rate?

- How is the additional “plus” 2% on earnings over $30,000/year calculated?

- What happens if I am contributing or have contributed at “9+2,” but I should be at a flat 11% because I chose to participate in RetirementPlus?

- I received an invoice for RetirementPlus, do I need to pay it?

- How much will I owe to make my account whole?

- What are my payment options?

- When will I receive my Invoice/Refund from the 2023 Special R+ Election?

- What if I choose not to participate in RetirementPlus and have contributed at 11%?

- Can I change my RetirementPlus election?

Background

The RetirementPlus (R+) program increases retirement benefits for eligible and participating members who have completed 30 years of service (at least 20 of which are membership service with the MTRS or the Boston Retirement System as a teacher), and subject to the statutory maximum of 80 percent, as follows:

- for members with effective membership dates before April 2, 2012, an additional 2 percent for each full year of creditable service in excess of 24 years (e.g., at 30 years of creditable service, an additional 12%, or 6 years x 2%).

- for members with effective membership dates on or after April 2, 2012, an additional 2 percent for each full year of creditable service in excess of 23 years (e.g., at 30 years of service, an additional 14%, or 7 years x 2%).

The contribution rate for RetirementPlus participants is a flat 11%. See more information about contribution rates here.

Original election of 2001

In February 2001, then-current members of the MTRS were mailed an Election Form and given until June 30, 2001 to affirmatively elect to participate in RetirementPlus. Members who did not return their election form were not included in RetirementPlus.

Special election of 2023

On August 3, 2022, then Governor Charlie Baker signed into law Chapter 134 of the Acts of 2022 which–among other changes to how RetirementPlus is implemented for MTRS members–allowed for members who had 1) transferred-in service between July 1 2001 and June 30, 2022 and 2) never responded to their original RetirementPlus participation decision a new special election opportunity period which ran from January 1 to June 30, 2023. The special election period has now come to a close.

RetirementPlus options for members who transfer to the MTRS from another Massachusetts public retirement system.

Final, one-time opportunity to participate in R+ for eligible members

Chapter 134 of the Acts of 2022 was signed into law in August of 2022 and allows eligible members a final, one-time opportunity to participate in RetirementPlus via an election that begins on January 1, 2023 and ends on June 30, 2023.

This opportunity to participate in the R+ program is only for those members who:

- were not a part of the original election window prior to July 1, 2001, AND

- transferred into the MTRS from one of the other 103 Massachusetts public retirement systems between July 1, 2001 and June 30, 2022, AND

- did not yet submit an election.

We are currently identifying eligible members and we will contact those members directly with further instructions.

RetirementPlus options for members transferring into the MTRS

Additionally, the new law changes the election procedures for members who transfer into the MTRS on or after July 1, 2022, and whose membership in another Massachusetts public retirement system was established prior to July 1, 2022. These members will now participate in the R+ program by default but can elect to opt-out within 180 days from the date the MTRS receives their transfer from the other system.

Finally, the law mandates participation in the R+ program for all new members of the MTRS who transfer into the system on or after July 1, 2022, and whose prior service in another Massachusetts public retirement system began on or after July 1, 2022. Like all other new teachers, these members have no election option and are required to participate in RetirementPlus.

Please refer to the table below for the impact to different member groups based on dates of membership and service.

Your MTRS Membership Date Date the MTRS receives the transfer of your account from the other Massachusetts public retirement system RetirementPlus Election Between 7/1/2001 and 6/30/2022 Between 7/1/2001 and 6/30/2022

- If we do not receive your R+ election as of 12/31/2022, you will be included in the special R+ election period, beginning 1/1/2023 and ending on 6/30/2023.

- If we do not receive your response to the special R+ election period by 6/30/2023, you will not participate in R+.

On or after 7/1/2001 with service starting in the other MA public retirement system prior to 7/1/2022 On or after 7/1/2022

- You will automatically be enrolled in R+ unless you opt-out within 180 days.

- If you participate in R+ but do not qualify for the benefit at the time of your retirement, you will receive a refund of your excess contributions.

On or after 7/1/2022, with service starting in the other MA public retirement system on or after 7/1/2022 On or after 7/1/2022

- Participation in R+ is mandatory, just as for all new teachers.

- If you do not qualify for the R+ at the time of your retirement you will not be eligible for a refund.

For tables showing the percentages of salary average allowed by age, years of service and formula (regular or RetirementPlus), please see “Retirement percentage” charts.

Inactive members of the MTRS must still make an election

In any scenario, if you become an inactive member of the MTRS and are provided with an opportunity to participate or not participate in RetirementPlus, you must still make this election and submit your decision to the MTRS.

We realize you may no longer be teaching in Massachusetts; however, it is important to act on your election because it will determine your contribution rate if you return as an active member of the MTRS or Boston Retirement Board.

Please log in to your MyTRS account to update any changes to your mailing address, email address, and phone number.

FAQs

I am participating in RetirementPlus. What does this mean for my retirement benefit?

If you are participating in RetirementPlus—because you either elected to participate or you became a member of the MTRS on or after July 1, 2001—you will be eligible to receive a RetirementPlus enhanced benefit if, at the time of your retirement, you:

- have accrued 30 or more years of creditable service, at least 20 of which are membership service with the MTRS or the Boston Retirement System as a teacher, and,

- have contributed at the RetirementPlus rate of 11% for at least five years, or have made accelerated payments to meet this contribution requirement.

However, if you are participating in RetirementPlus because you elected to participate in RetirementPlus, and you:

- do not accumulate 30 years of creditable service by your date of retirement, you will receive a retirement benefit calculated under the regular formula, and a refund of your RetirementPlus contributions, plus regular interest.

- retire with 30 or more years of creditable service, but fewer than 20 of your years are as a member of the MTRS or the Boston Retirement System as a teacher, you will receive the regular retirement benefit and a refund of your RetirementPlus contributions, plus regular interest.

Please note that if you are participating in RetirementPlus because you became a member of the MTRS on or after July 1, 2001, and you do not meet the criteria to be eligible for the enhanced RetirementPlus benefit, you are not entitled to a refund as your contribution rate of 11% was mandatory.

I am not participating in RetirementPlus because I elected not to participate (or I didn’t submit a timely election form). Can I elect in now?

For the majority of members, the answer is “No”; your election opportunity was a one-time chance. If you did not elect to participate, you cannot later opt in. If, however, you leave MTRS service, take a refund of your annuity savings account and then return to MTRS service, you will return as a new member and automatically be subject to RetirementPlus and the contribution rate of 11%. The only exception was for members who were not a part of the original election window prior to July 1, 2001, and transferred into the MTRS from one of the other 103 Massachusetts public retirement systems between July 1, 2001 and June 30, 2022, and did not yet submit an election. These eligible members had a final, one-time opportunity to participate between January 1, 2023 and June 30, 2023.

How do I know if I am subject to RetirementPlus?

If you:

- Transferred to the MTRS from another Massachusetts contributory retirement system:

- Prior to July 1, 2022 – transferred to the MTRS from another Massachusetts contributory retirement system on or after July 1, 2001, you had 180 days from the date that you transferred into the MTRS to enroll in RetirementPlus. If you submitted an affirmative election within 180 days, you are subject to RetirementPlus.

- After July 1, 2022 – transferred to the MTRS from another Massachusetts contributory retirement system on or after July 1, 2022, you have 180 days from the date that you transferred into the MTRS to opt-out of RetirementPlus. If you do not submit an election choice within 180 days, you will be subject to RetirementPlus.

- joined the MTRS as a new member to a Massachusetts public retirement system on or after July 1, 2001, you are automatically enrolled in RetirementPlus.

- were a member of the MTRS prior to July 1, 2001, you had until June 30, 2001 to elect to participate in RetirementPlus. If you did not submit a timely, affirmative election, you were not enrolled in RetirementPlus and your contribution rate remained the same.

How can I check my contribution rate?

Look at your pay stub. Divide the amount of your retirement withholding by your gross income, and then refer to the contribution chart. For example, if your enrollment date is January 2, 1979 and your salary is $35,000, your total contribution would be 7% of $35,000 plus 2% of $5,000. The 2% contribution does not apply to RetirementPlus participants.

If your contribution rate is not correct, confirm your calculation with your payroll office and then contact the MTRS. Note: If the 2% contribution also applies, be sure it appears on your pay stub.

For more info, watch this section of our RetirementPlus special election seminar, recorded on 02/23/2023 (link will open in YouTube).

Why is the “9+2” regular contribution rate not the same as the 11% RetirementPlus contribution rate?

If you are not participating in RetirementPlus, you are contributing at one of the lower contribution rates within the grid above—most likely the 9% flat rate on your entire salary, with an additional 2% on earnings over $30,000. This rate is called “9+2” or “9 and 2.” Pay stubs may also label these additional 2% contributions as “RET2,” “ADDL2%,” “PLUS2,” or some variation of these examples. Some members may also hear or see the word “plus” and believe this means RetirementPlus.

The differences between these two rates can be confusing because the lower “9+2” rate is a common rate established at other Massachusetts contributory retirement systems, one could assume that 9% plus 2% on earnings over $30,000/year adds up to a flat 11%, but that is not the case. It is important to remember that the additional 2% withholding is only on a portion of your salary, not the entire amount.

For example: Joe Teacher recently transferred into the MTRS from another Massachusetts contributory retirement system.

R+ Flat 11% Contribution Rate

If Joe decides to participate in R+, his bi-weekly contribution would be:

$2,230.77 x 11% = $245.38

“9+2” Contribution Rate

If Joe decides to opt out of R+, his bi-weekly contribution would be:

$2,230.77 x 9% = $200.77

2% contributions on earnings over $30,000: $21.54$200.77 + $21.54 = $222.31 (total “9+2”)

The difference between both contribution rates is $23.07 ($245.38 – $222.31). The annual difference is $600 ($23.07 x 26). The difference per paycheck will vary depending on the number of paychecks you receive in a year; however, the annual difference between 11% and “9+2” will always be $600/year, unless something abnormal occurs with your pay or you make less than $30,000 in one calendar year.

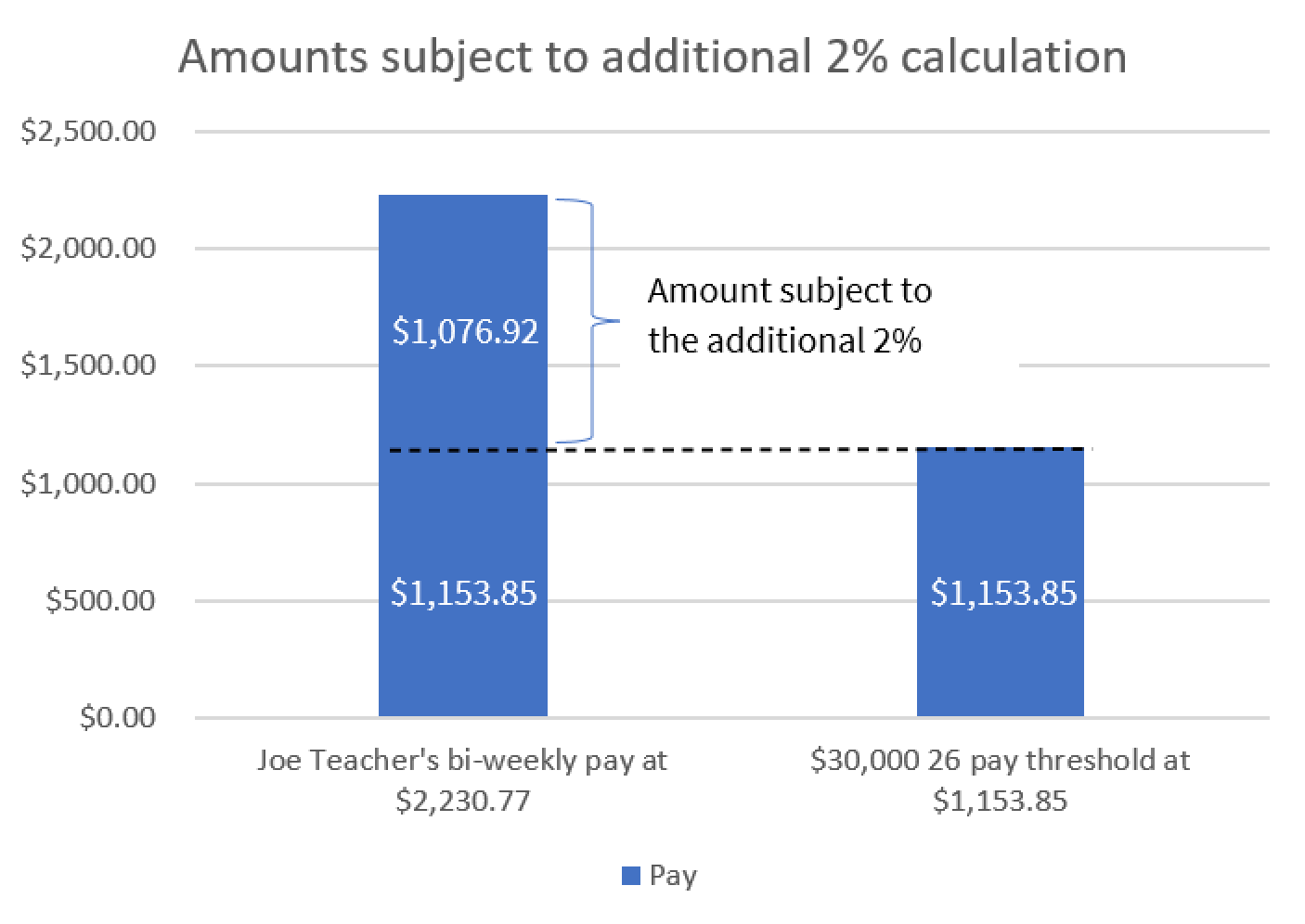

How is the additional “plus” 2% on earnings over $30,000/year calculated?

According to PERAC memo #43 from 1999, the additional 2% must be calculated on a per pay period basis. Rather than subtracting $30,000 from your entire salary, it must be done incrementally from each pay throughout the year.

First, you must figure out the number of times you are paid each year. Many members receive their pay over 26 pay periods; therefore, we will use this in our calculation example.

If Joe Teacher makes $58,000 per school year and is paid bi-weekly over 26 pays, his gross bi-weekly pay is $2,230.77, the portion of which “above” $30,000 is $1,076.92 ($30,000/26=$1,153.85; $2,230.77-$1,153.85=$1,076.92)

The 2% is then withheld from $1,076.92. Joe’s 2% contribution is $21.54 ($1,076.92 x 2%).

For more information on the difference between 11% and 9%+2% contribution rates, watch this section of our RetirementPlus special election seminar, recorded on 02/23/2023 (link will open in YouTube).

What happens if I am contributing or have contributed at “9+2,” but I should be at a flat 11% because I chose to participate in RetirementPlus?

If you elected to participate in RetirementPlus and your school district is currently withholding at a rate lower than 11%, your rate will need to be changed immediately. As a reminder, someone who chooses to participate in RetirementPlus will owe the difference between 11% and any lower rate. All shortages in your account, going back to your MTRS membership date, must be paid to make your account whole.

You will eventually receive these contributions back as part of your future retirement benefit; however, it is important for the system to invest these funds to provide you and all our members with a lifetime benefit.

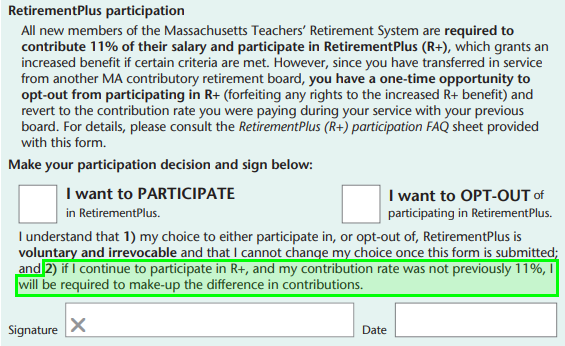

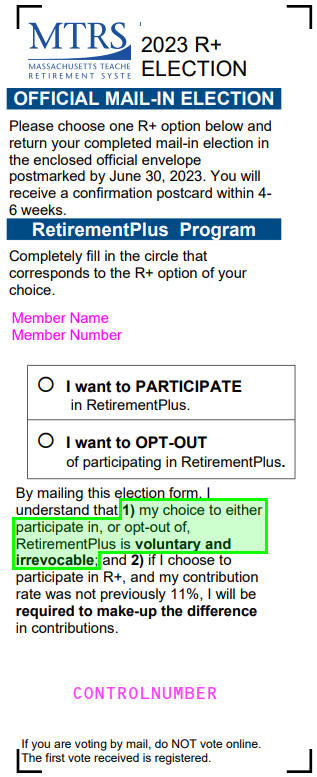

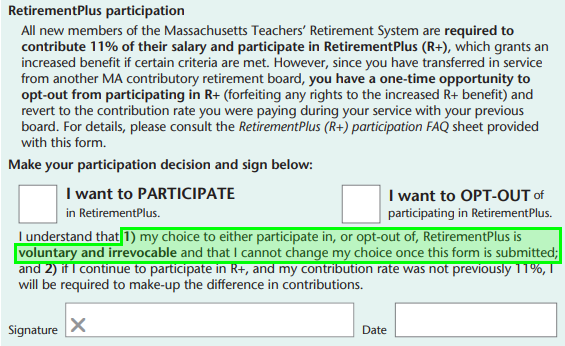

I received an invoice for RetirementPlus, do I need to pay it?

Yes, you agreed to make up the difference in contributions if your contribution rate was not previously at 11% when you made your election. For reference, please see the highlighted text from the 2023 special election ballot and also our standard RetirementPlus participation form.

2023 RetirementPlus special election ballot

RetirementPlus participation form

How much will I owe to make my account whole?

This amount may vary; however, as stated above, the amount is generally $600 per year for members contributing at “9+2”. You will owe the difference going back to when you first became a member of the MTRS. If you owe 10 years’ worth of contributions, you will owe approximately $6,000 ($600/year x 10 years). If you were at a rate lower than “9+2”, you would owe significantly more because the difference between 11% and an even lower rate will produce a higher amount.

The final amount will be calculated once your rate has been changed to 11% and posted to your annuity savings account.

What are my payment options?

If you owe money to the MTRS to make your account whole, you have the following options:

- Pay in full by check

- Transfer money over from a qualified supplemental retirement plan

- Trust-to-Trust Transfer Acknowledgment Form for a plan that you are still actively contributing to

- Direct Rollover Acknowledgment Form for a plan that you have stopped contributing to

- A five-year installment plan if your amount is $1,000 or higher. This plan will include interest at one half of the actuarial rate of return, which is currently at 3.5% (actuarial rate is currently set at 7% for CY2023).

If you choose not to pay your invoice, interest will accrue on the principal amount at the buyback rate, starting on the day of your first due date (currently 90 days from the MTRS mailing out your invoice) until the time of payment. This must be paid in full prior to your retirement date.

When will I receive my Invoice/Refund from the 2023 Special R+ Election?

We are working hard to finalize and work through almost 8,000 cases. You will receive an email with your final determination. Please keep your email address updated through your MyTRS account and periodically check your spam/junk folder for any of our communications. You can find more information pertaining to the 2023 project here.

What if I choose not to participate in RetirementPlus and have contributed at 11%?

If you have contributed at 11% and choose not to participate in RetirementPlus, the MTRS will ensure that you are no longer contributing at 11% and calculate what you should have contributed to the MTRS at your lower rate, making your account whole and returning the principal amount to you. When feasible, the IRS requires these contributions to be returned as a payroll credit or as an MTRS refund directly to the member. The refund will have 10% withheld for federal taxes, and you will receive a 1099-R at the beginning of the following year. These refunds are not eligible for rollovers to other financial institutions.

Interest earned on these contributions will remain in your MTRS annuity savings account and be used to fund your future benefit. In rare circumstances, some members may owe contributions to make their account whole due to other shortages.

Can I change my RetirementPlus election?

No, you agreed that your choice was voluntary and irrevocable when you made your election.

For reference, please see the highlighted text from the 2023 special election ballot and also our standard RetirementPlus participation form.

2023 RetirementPlus special election ballot

RetirementPlus participation form