Monthly deduction reports and payments are due to the MTRS the 10th of the following month in accordance with M.G.L c. 32, § 22 (e.g., September’s report and payment are due October 10).

Monthly payments can be made via EFT, direct deposit (currently available on a limited basis) or check. Payments made via check must be mailed to the address on the required submittal form. Please do not send any additional paperwork with the check and submittal form; all reporting must be completed online in MyTRS.

Monthly report files are generally exported from your school’s payroll software, in our file layout format, and then imported into MyTRS. For a step-by-step list of this process, see our Monthly Deduction Reporting Checklist.

Deduction reporting tips and reminders

We suggest that you review these at the beginning of each new school year to ensure you have everything set up properly before the first payroll.

1. Only report what actually happened.

The monthly deduction reports need to reflect what actually happened during that month. If you overpaid or underpaid someone, that’s what the report needs to show. If the wrong deductions were taken, that’s what you need to show, even if you have corrected the deductions by the time you are working on the report.

Example: Deductions on an employee’s coaching earnings were not taken on her 09/26 check. You realize the mistake and collect the missed deductions on her 10/17 check.

- Your September report should reflect that the employee was paid for coaching and that no deductions were taken.

- Your October report should show the collection of the deductions as an adjustment record.

2. Register new employees in MyTRS and give them their Enrollment Assignment Sheet.

Employees who meet the membership eligibility criteria must be registered in MyTRS. As instructed during the online registration process, be sure to print the “MTRS Enrollment Assignment Sheet” and give it to the employee so they can complete the online enrollment process.

3. Register your coach-only employees if they are MTRS members through another district.

If you employ coaches who are not teachers in your district, but who are MTRS members through another employer, you are required to deduct MTRS contributions from their pay.

Set their records as follows:

| FTE% | 0 |

| Pay Duration | 01, 02, 03 or 06 |

| Pay Frequency | 01, 02, 03 or 06 |

| Contract Term | 01, 02, 03 or 06 |

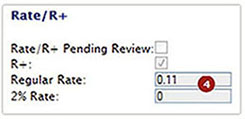

4. Check a new employee’s deduction rate in MyTRS.

After you register a new employee, it is imperative that you to check their deduction rate in MyTRS so you can set them up properly in your payroll system.

To check a member’s rate:

1. Go to the View/Update Employee information.

2. If you have just completed the member’s registration, their name should already be showing on the screen. If you have not just completed the registration, please enter the member’s last name in the Select Member field and click the Search button.

3. When the member’s record is displayed, click on the Employment tab along the top of the page.

4. The member’s rate with MTRS is listed at the bottom of the page under Rates/R+

To see how the MTRS determines a member’s rate, see Contribution rates explained.

5. Do not change contribution rates for existing employees unless requested by the MTRS.

If you have existing employees with detected rate discrepancies, please do not change their deduction rates unless your MTRS representative has specifically requested the change.

6. Report the correct annual salary to ensure that the member will receive the proper service credit.

Note: MyTRS always needs the full-time, full year, non-adjusted contractual annual salary (from the salary schedule for members covered by a collective bargaining agreement).

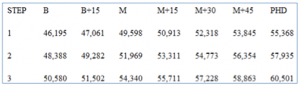

Example:

Using the above salary schedule, you have an employee who is at M+15 Step 2.

| If the employee… | The annual salary to use in MyTRS is… |

| • Is working full-time | $53,311 |

| • Is working part-time | $53,311 |

| •Starts the year late | $53,311 |

| • Is on, or has returned from, a leave of absence and is receiving prorated bi-weekly pay | $53,311 |

Important note: It is common for some payroll software programs to prorate or recalculate annual salaries for some of the situations above, so be sure to check that you are reporting the full-time contractual salary in MyTRS.

7. Eligible longevity and stipend payments need to be reported separately from base pay and annual salary.

If you have employees who receive eligible longevity or stipend pay, these payments need to be broken out in the deduction report into the appropriate reporting categories. They should not be reported as base pay and should not be added to the annual salary field in MyTRS. Please contact your payroll company if you are not sure how to set up the different types of payment categories.

To verify what pay is pensionable—and, therefore, subject to retirement deductions—see regular compensation.

Example:

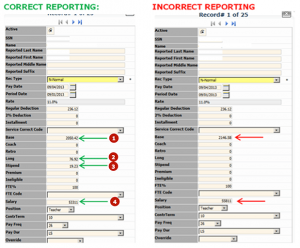

You have an employee who:

- is at M+15 Step 2 ($53,311.00),

- receives $2,000 in longevity,

- receives a $500 stipend, and

- is on a 26-pay cycle.

- The regular bi-weekly per check is $2,050.42 and needs to be reported in the Base field in MyTRS.

- The longevity per check is $76.92 and needs to be reported in the Longevity field in MyTRS.

- The stipend per check is $19.23 and needs to be reported in the Stipend field in MyTRS.

- The annual salary is $53,311.00 and needs to be reported in the Salary field in MyTRS.

8. Be sure the employee has the proper position code in your payroll system, and the proper position in your deduction reports.

Example: If someone is a Guidance Counselor, their position in MyTRS should be Guidance Counselor, not Teacher. The position code in your payroll software should be GUIDE.

Acceptable position codes that may appear in your deduction report import file:

| Position in MyTRS | Position code in your payroll software |

| Superintendent | SUPT |

| Charter School Leader | LEADER |

| Collaborative School Director | COLDIR |

| Teacher | TEACH |

| Kindergarten Teacher | KINDER |

| Coach (as primary title) | COACH |

| Administrator | ADMIN |

| Principal | PRIN |

| School Nurse | NURSE |

| Other | OTHER |

| Psychologist or psychiatrist | PSYCH |

| Librarian | LIBRA |

| Assistant Principal | ASPRIN |

| Assistant Superintendent | ASUPT |

| Guidance Counselor | GUIDE |

| School Social Worker | SOCIAL |

| School Adjustment Counselor | ADJUST |

| Speech and Language Therapist | SPEECH |

| Occupational Therapist | OT |

9. Report changes in name, address, position or FT% via your deduction report.

Name and address changes are reported to the MTRS via the monthly deduction report for active members. Simply update the member’s name and/or address in your payroll system and the new information will be passed to us in the next monthly deduction report. Once that deduction report has been imported and processed successfully, our database will be updated with the new information.

The same policy holds true for position changes and FT% changes. A new event should not be created in MyTRS for these types of changes, simply update them in your payroll system, and the new information will be passed to us in the deduction report.

10. Report pro-rated paid leaves to your Employer Services Representative.

When a member goes out on leave and their bi-weekly pay is adjusted over more than one check, please fill out the Leave of Absence Information form and return it to your Employer Services Representative (ESR). We no longer lower the member’s FT% or use the Partially Paid Leave event for these scenarios. Once your ESR receives the completed leave form, they can assist you in creating the appropriate event in MyTRS.

11. Payroll Calendars are usually created in December, but can be created at any time.

The payroll calendars in MyTRS are based on a calendar year and not a school year. You can create the calendars anytime you want, but they are typically created in December since they run from January 1–December 31. If your school offers a new pay frequency one year that was not offered the prior year, you may need to create a new calendar for that pay schedule before submitting your September report.