IMPORTANT NOTE: The MTRS is not qualified to provide specific advice relative to the federal tax code. You should consult your personal accountant and/or obtain a copy of Internal Revenue Service (IRS) Publication 575, Pension and Annuity Income, to ensure that you are in compliance with all of the appropriate federal requirements.

Taxes and your retirement allowance

The superannuation retirement allowance that you receive from the MTRS is exempt from taxation under the Massachusetts income tax laws. The federal government (Internal Revenue Service (IRS)), however, will tax a large portion of your retirement allowance immediately upon retirement. Approximately 95-98% will be taxable at the federal level, depending on how much after-tax money you have in your MTRS annuity account at the time of your retirement, as explained below.

Upon your retirement, you will be required to complete a W–4P Form to begin a monthly federal tax withholding. It is very important that you complete a tax withholding form in conjunction with your retirement. If no form is filed with your retirement board, the retirement board is required by federal law to withhold taxes, starting with your second retirement check, as if you were a married person with three exemptions. It is also possible to request that no taxes be withheld. However, if no taxes are withheld, you should submit estimated quarterly payments to the IRS. You may change your federal tax withholding amount at any time during your retirement simply by notifying us.

Your tax liability will be determined by using the Internal Revenue Service’s Simplified Method. The tax-free portion depends on the amount of your after-tax contributions to the retirement system, when your contributions were made, and your life expectancy at the time of your retirement.

Since January of 1988, all contributions to the retirement system are being made on a pre-tax basis. Consequently, only your contributions made prior to January of 1988 and any purchases of creditable service made with after-tax dollars will be eligible for exclusion from your federal taxes. Pre-tax contributions and all of the interest which your account has earned cannot be used when you figure the yearly tax-exempt portion of your retirement allowance.

Changing your federal tax withholding

Your retirement benefit is subject to federal income taxes. If you are a Massachusetts resident, however, your benefit is not subject to state income taxes. At the time of your retirement, we ask you to instruct us whether you want us to withhold any amount for income taxes and, if so, how much.

Please note:

- Unless you direct us otherwise, we must withhold federal income tax starting with your first payment.

- You may change your tax withholding amount at any time before or during your retirement by notifying us in writing. Simply download a Form W-4P, complete it and send it to our main office. Be sure that you mail your form so that it is received in our office by the 15th of the month in which you want the change to occur.

- If you need help in determining your federal tax withholding, use the IRS’s online tax withholding estimator to assist you with your tax withholding preferences. (Note: the MTRS receives no information from this tool. If you use it to determine your tax withholding preferences, you will still need to submit a Substitute Form W-4P to us to make changes to your federal tax withholding.)

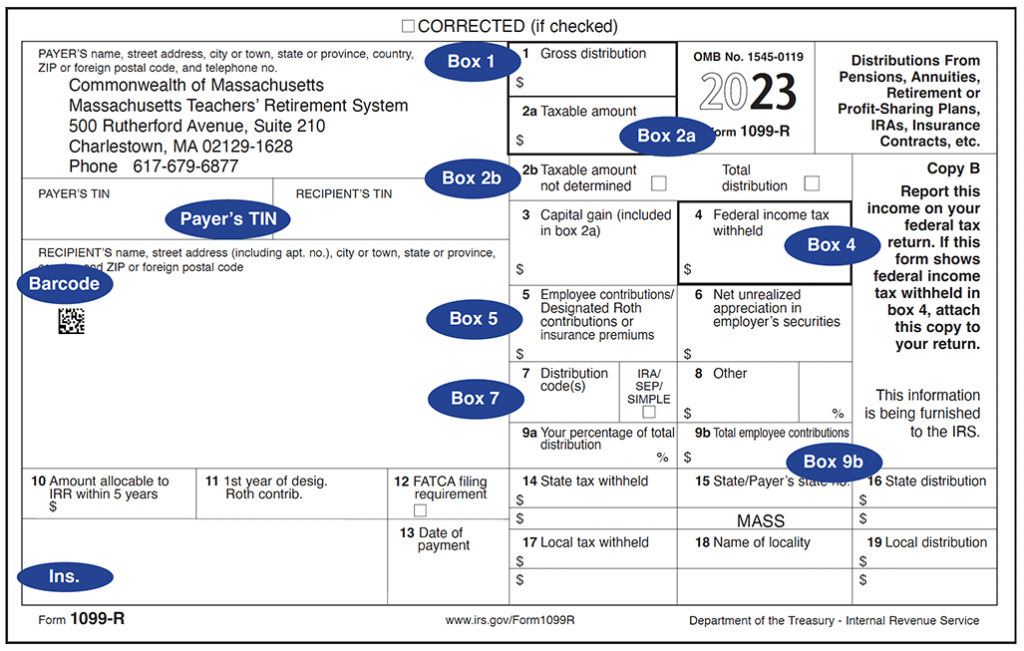

How to read your 1099-R Form

While we have included an informational insert with your 1099-R Form, below is additional information that we hope you find helpful in reading your 1099-R Form.

- Barcode: This small square barcode is printed on your form solely to ensure mailing accuracy. It is not a scannable Quick Response (QR) Code, and does not contain any personal information.

- Payer’s TIN (“Payer’s Identification Number”): The type of Taxpayer Identification Number (TIN) used by the MTRS is a federal Employer Identification Number (EIN) and can be found in this box.

- Box 1, Gross distribution: This shows the total distribution amount that you received from the MTRS for the calendar year 2023.

- Box 2a, Taxable amount: This shows the distribution amount that is taxable. If part of your distribution is not taxable, the nontaxable amount will be displayed in Box 5. If there is no amount in Box 5, the MTRS may not have all the necessary information to determine the taxable amount. In that case, in Box 2b, “Taxable amount not determined” will be checked.

- Box 2b: If “Taxable amount not determined” is checked, then the MTRS did not have all of the necessary information to determine the taxable amount, and Box 2a will be blank (see Box 2a, above). In this case, you should determine the non-taxable amount yourself. You may find additional information on how to calculate the non-taxable portion of your benefit in IRS Publication 575 or in the 1040 Workbook under the heading of “Pension Annuity Income” or see the sample Simplified Method worksheet on our website. The other box, “Total distribution,” is checked when there are no further distributions payable to you from the MTRS. For example, the 1099-R issued in the year of a retiree’s death would display “Total distribution” to let the IRS know that the retiree’s monthly benefit payments have ceased.

- Box 3: Not applicable for MTRS retirees.

- Box 4, Federal income tax withheld: This shows the total amount of federal income tax withheld for calendar year 2023.

- Box 5, Employee contributions/Designated Roth contributions or insurance premiums: The title of Box 5 does not accurately reflect what it means for retirees of the Massachusetts Teachers’ Retirement System—in our case it is not related to insurance or Roth contributions. Box 5 actually represents the portion of your after-tax contributions to the MTRS that you are entitled to exclude from your Gross Distribution (in Box 1) for calendar year 2023. It is equal to the difference between your taxable amount (in Box 2a) and the total Gross Distribution (in Box 1). If there is an amount in Box 5, it means that, when you began to receive your MTRS benefit, you had “after-tax” money in your MTRS account—money that you had already paid taxes on. When you begin receiving your benefit, you may “exclude” that after-tax money from your taxable amount over a period of years.

- Box 6: Not applicable for MTRS retirees.

- Box 7, Distribution code: This IRS code identifies the type of distribution you received from the MTRS. The codes are also described on the back of your 1099-R Form.

- 2 : Applies to certain distributions including regular retirement benefits paid to retirees under the age of 59-1/2.

- 4 : Identifies payments received by a survivor, beneficiary or estate of a deceased member or retiree.

- 7 : Identifies payments to retirees over the age of 59-1/2.

- Boxes 8 and 9a: Not applicable for MTRS retirees.

- Box 9b: The amount in Box 9b, if any, represents the remaining total after-tax contributions that you will be allowed to exclude over your lifetime. (Whereas Box 5 represents the amount you may exclude for calendar year 2023, Box 9b shows the remaining amount that you may exclude over the coming years.)

- Ins. (Insurance): If any amount was withheld for your group insurance in 2023, the total will be listed next to “Insurance” in the box in the lower left corner of your 1099-R. Included in this total are your health care premiums only; your life insurance premiums, if any, are not included. We provide this information as a service to you, to assist you in preparing your taxes; we have not provided this information to the IRS.

If you itemize deductions, then this figure can be used for Schedule A. Do not use the figure in Box 5, which, for our retirees, is not related to insurance.

Note to recent retirees: When you were an active educator, your health insurance premiums may have been withheld on a pre-tax basis. However, federal tax law requires that retirees’ insurance premiums be withheld on an after-tax basis.

Your insurance is administered either by the Group Insurance Commission or your local school district. To determine which agency administers your insurance, look at the Deductions portion of pension check or direct deposit statement. If your deduction is listed as:

- GROUP INS or GIC DNTL, contact the Group Insurance Commission at

617-727-2310, ext. 6, with any questions. - MEDICAL D, MEDICAL I, DENTAL, LIFE INSU, OPTIONAL or OTHER MED,

contact your school district’s insurance coordinator for information.

FAQs

I received more than one 1099-R Form from the MTRS. Why?

It is not unusual to receive more than one 1099-R for a tax year. This can occur as a result of one of the following:

- You reached age 59-1/2 during the tax year. (Exception: if you are receiving accidental disability benefits, then you will receive only one 1099-R for the year during which you reached age 59-1/2.)

- You are receiving your own MTRS retirement benefit and a survivor benefit from a former MTRS member.

- You are receiving your own MTRS retirement benefit and, as a result of a Qualified Domestic Relations Order (QDRO), you are also receiving a benefit from another MTRS member.

- You are receiving an MTRS ordinary disability retirement benefit and you turned age 55 during the calendar year.

- You are receiving your own survivor or accidental disability retirement benefit, and benefits on behalf of your dependent children (you will receive a 1099 for your benefit, and one for each dependent child, all reported under your Social Security number).

- In addition to a monthly benefit payment, you also received a refund payment from the MTRS.

I received two 1099-R forms because I turned 59-1/2 during the tax year. Why—and what does this mean?

In the tax year in which you turn 59-1/2, you will receive two 1099–R forms from us, as the IRS requires that we identify and distinguish between payments that are made to you when you are under age 59-1/2, and payments that are made to you when you are over age 59-1/2. Accordingly, please note:

- Each form will be different: One will reflect the amount totals for the months that you were under age 59-1/2, and will have a distribution code of 2 in Box 7; the other will reflect the amount totals for the month in which you turn 59-1/2 as well as for the following month(s) that you were over age 59-1/2, and have a distribution code of 7 in Box 7.

- You will need both forms to determine your tax reporting information for the year: To get your annual totals, simply add the different amounts on the two forms. For example, to determine the total amount that you received from the MTRS for the year, add the figure in “Box 1, Gross distribution,” on one form to the figure in “Box 1, Gross distribution,” on the other.

Does the MTRS give tax advice?

No. You should seek advice from a professional tax advisor or the Internal Revenue Service.

What should I advise my family or executor to do in the event of my death?

Please advise your survivors to go to our website and see our page on how to report the death of a benefit recipient.

Can I access my 1099 online?

Yes—if you are currently receiving your own monthly retirement allowance, or survivor benefit, you may access your 1099 in MyTRS, our online member account system. Here’s how:

- Go to the MyTRS sign in page. If you have an account, Sign in and skip to step 6. If you do not have an account, click Create an account and continue to step 2.

- Review the MyTRS Terms of Service agreement. Make sure to scroll all the way down and click the Accept

- Enter your Date of Birth and Social Security number and click Next.

- Enter your username and password and click Next.

- Choose your security questions and click Next.

- Select your preferred method for Two-Factor Authentication code (2FA) delivery method and click Next.

- Follow the instructions to enter your 2FA code. (If you choose to receive your 2FA code as a text message, it must be sent to a cell phone number. Land lines do not support text messages.)

- Once logged in, on your home page, click Documents (in the left margin). In the table listing your available documents, find your 2023 1099-R, which will have a date of 01/18/2024, and then click Download. If you have multiple 1099s, be sure to look for all 1099s with a date of 01/18/2024 to obtain your 2023 tax information.

- To exit MyTRS securely, please click Logout in the top right corner.

In MyTRS, do NOT use your browser’s Back or Refresh buttons, as they may disrupt your connection and cause your session to become invalid. To navigate within MyTRS, always use the links in the left margin.

Watch our video!

To determine your federal tax liability of your retirement allowance in your first year of retirement, review and complete the following sample worksheet. The example illustrates the calculations for a retiree who is 59 on her retirement date of June 30 and who receives an annual retirement allowance of $30,000.

Please be aware that this worksheet is adapted from the IRS version and applies only to your federal tax liability on your MTRS retirement allowance in the first calendar year of retirement. It does NOT account for any other pension or annuity plans you may have and it does NOT address your potential tax liability after this first year. For additional information, contact the IRS, refer to IRS Publication 575 or discuss this with your accountant or tax advisor.

Sample worksheet: This is not an interactive worksheet that you can fill in on screen. Accordingly, you may want to print this page and complete the worksheet on paper.

| Line | Example | You | |

| 1 | Enter the total retirement allowance amount that you will actually receive this year. (In the example, the retiree received her allowance for July 1 through December 31, or for 6 of 12 months, which equaled $15,000 for the period.) | $15,000.00 | |

| 2 | Enter the total amount of your after-tax contributions to your annuity savings account. This amount is equal to your total contributions prior to January 1, 1988, plus any after-tax service purchases you made after January 1, 1988, and is listed on your Notice of Estimated Retirement Benefit (Estimated After-Tax Contributions) that we send you prior to your retirement. | $21,000.00 | |

| 3 | If you retired:

|

310 | |

| 4 | Divide Line 2 by Line 3 and enter the result | $67.74 | |

| 5 | Enter the number of months for which you will receive retirement allowance payments this year | 6 | |

| 6 | Multiply Line 4 by Line 5 and enter the result | $406.44 | |

| 7 | Subtract Line 6 from Line 1 and enter the result. This is your taxable amount. | $14,593.56 |

**To determine the annual amount to be excluded from your pension income in the following year, take the amount from Line 4 and multiply by 12.