Understanding the COLA on your August benefit statement

The Governor signed the FY2024 budget into law on August 9th. The budget includes a cost-of-living adjustment (COLA) effective July 1, 2023, providing a 3% increase on the first $13,000 of your retirement benefit. This results in a maximum increase of $390 per year or $32.50 per month (3% x $13,000/year = $390/year; $390/year ÷ 12 months = $32.50/month).

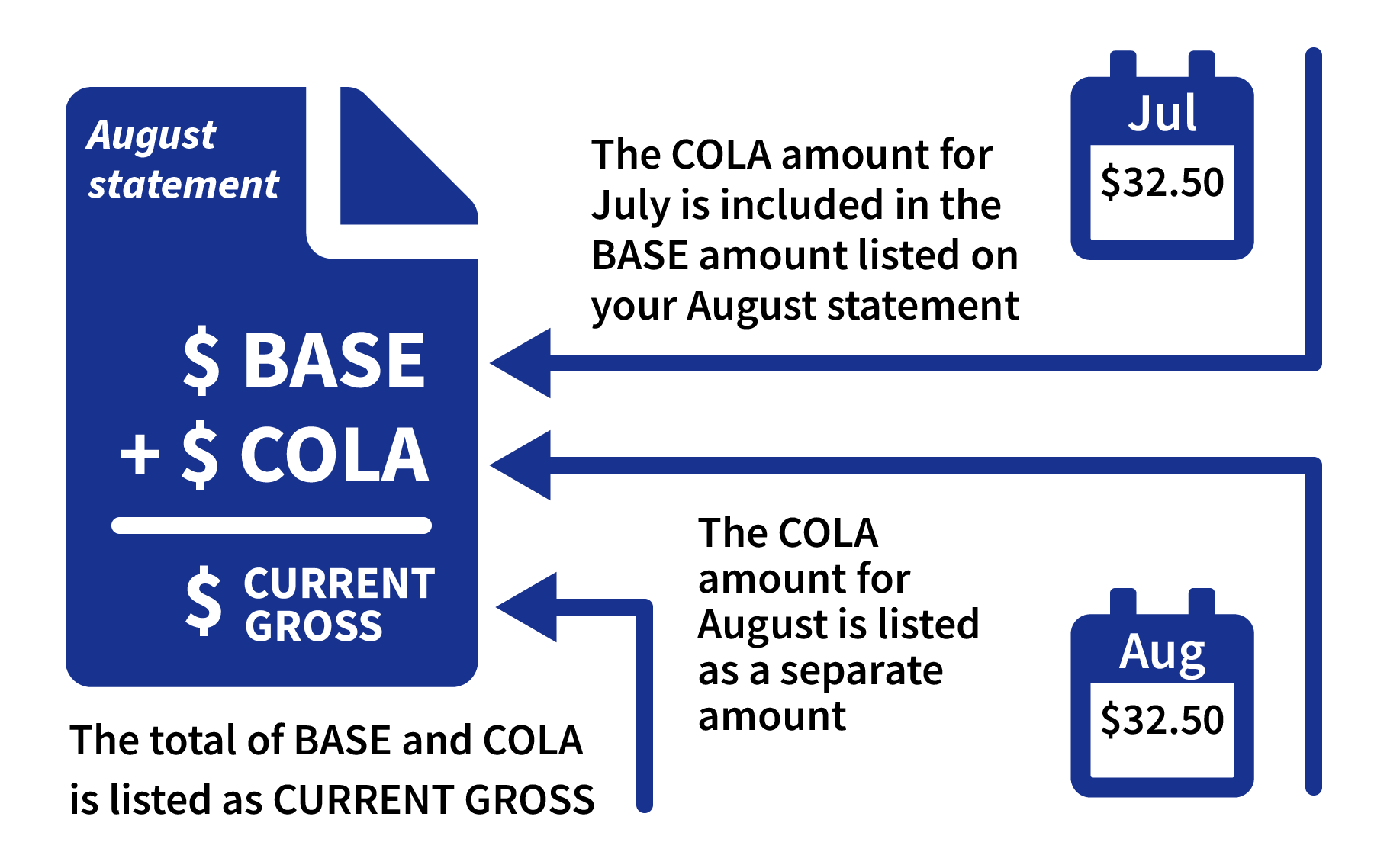

The FY2024 COLA was approved after our administrative cut-off date for the July benefit payments. As a result, this month’s payment will encompass the COLA for BOTH July and August. The July COLA amount is included as a one-time retroactive increase in the BASE line, while only the August COLA is listed in the COLA line. Please note that unless you had previously chosen not to have federal taxes withheld, the MTRS applied a one-time 10% tax withholding to your retroactive July COLA amount. Your September payment will reflect your new monthly benefit amount, inclusive of any applicable federal tax withholding.

The chart below illustrates how the payments will be detailed on your August paystub:

As a reminder, retirement and survivor benefits are disbursed for time already accrued. The allowance you receive at the end of August is the payment for the month of August.

You are eligible to receive this COLA if you fall into one of the following categories:

- A retiree who retired on or before June 30, 2022

- A survivor of an Option C retiree who retired on or before June 30, 2022

- A survivor of a member who passed away while in active service on or before June 30, 2022

- An accidental death benefit recipient whose benefit began on or before June 30, 2022

Questions? See your benefit payment, how to read your check or direct deposit statement or email GenInfo@trb.state.ma.us.