Your benefit payment

Retirees

Retirement and survivor benefits are paid for time already accrued. In other words, the allowance that you receive at the end of January is the payment for January.

As a reminder, you will not receive a direct deposit statement every month. Direct deposit statements are only mailed when…

- your first direct deposit is made;

- there is a change in the amount of your direct deposit from the prior month (for instance, if you change the amount of your federal tax withholding or your insurance premium changes);

- the MTRS needs to inform retirees of new information and prints a special notice on the top portion of the direct deposit statement; and

- the MTRS provides you with your year-end statement in December, showing your complete year-to-date information for the calendar year.

About direct deposit (Electronic Funds Transfer/EFT)

Direct deposit is a safe, convenient way to receive your retirement allowance. You don’t have to worry about your check being stolen or lost in the mail, or having to cash the check on your own. If you are still receiving your payment via check, consider changing—over 95% of our benefit recipients now receive their retirement allowance through direct deposit! To sign up for direct deposit, simply download our Direct Deposit Authorization Form or call our main office at 617-679-6877 to request a copy.

Please note:

- Pursuant to 807 CMR 18, Massachusetts law now requires MTRS members who retire after November 27, 2009 to receive their benefits via direct deposit. Members who retired prior to November 27, 2009 and who currently receive paper checks can sign up for direct deposit at any time.

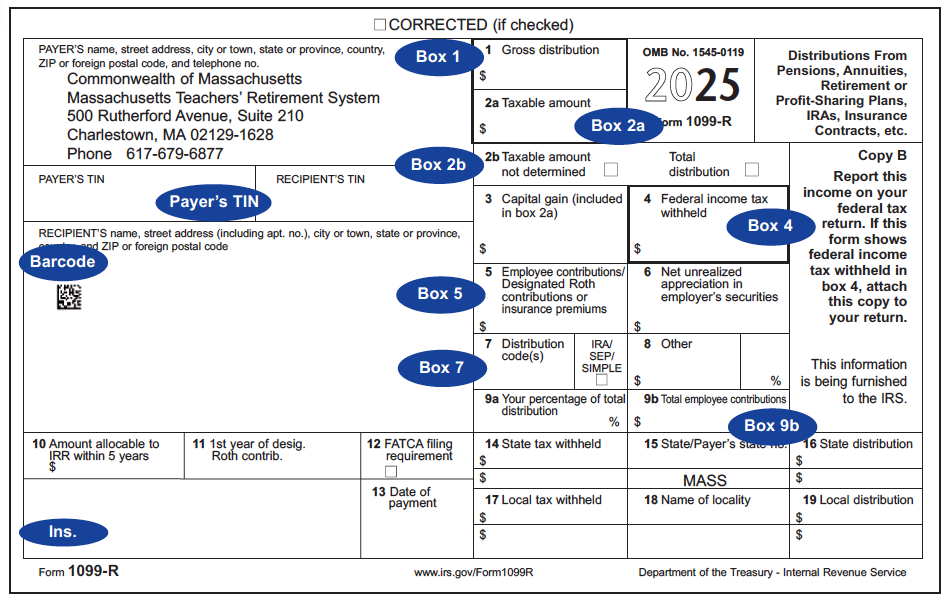

- Even if you are on direct deposit, you must keep us informed of any change in address, so that you will receive direct deposit statements, 1099-R tax form and other mailings from us.

To transfer your existing direct deposit of your retirement or survivor benefit

- to another bank or to another account within the same bank, complete and return a new Direct Deposit Authorization form. Please note: You should not close your old account until the first deposit has been made to your new bank or you receive a retirement check at home. The process of changing your direct deposit from one account to another takes approximately two months to complete. Occasionally, before the changeover is completed, one check may be mailed to the address shown on the Direct Deposit Authorization form.

If the new account is a checking account, please attach a voided check to your correspondence.

If your check is lost or stolen

- Lost: Please check the Pension payment schedule for the dates on which your pension checks are mailed. If you do not receive your retirement check after one week of the check mailing date, send us a letter stating that your check has been lost and requesting that we stop payment on the check. (Please note that we must receive your request for a stop payment in writing, and wait at least ten business days from the check mailing date before we can stop payment.) Please allow two weeks for the replacement to be sent.

- Stolen: Please call our main office immediately, at 617-679-MTRS (6877).

Direct deposit statements are only mailed when…

- your first direct deposit is made;

- there is a change in the amount of your direct deposit from the prior month (for instance, if you change the amount of your federal tax withholding or your insurance premium changes);

- the MTRS needs to inform retirees of new information and prints a special notice on the top portion of the direct deposit statement; and

- the MTRS provides you with your year-end statement in December, showing your complete year-to-date information for the calendar year.

For more information, see How to read your check or direct deposit statement.

Looking for the address to mail your Benefit Verification Form?

Please mail your form to:

Massachusetts Teachers’ Retirement System

500 Rutherford Avenue, Suite 210

Charlestown, MA 02129-1628

FAQs

Why does the MTRS do this?

The Massachusetts retirement law requires that the MTRS perform, at least once every two years, a verification of all retirees and beneficiaries who receive a monthly benefit (840 CMR 15.01 ).

What is the purpose?

Our job is to pay the appropriate retirement or survivor allowance to the unique person who earned the particular benefit. In some cases, we have discovered that, after a retiree has died, a family member has continued to collect benefits—even though that family member is not eligible for any survivor benefits. In order to ensure that benefits are still being paid to the correct individuals, by law, we must confirm that the intended recipients are still alive and, therefore, eligible to receive benefits.

This is a very serious process, intended to prevent the fraudulent collection of pension benefits by ineligible parties.

If I receive a form in the mail, do I HAVE to complete and return it?

Yes. If you receive a form from us, you most definitely have to complete and return it. If you do not return your completed form by the due date indicated on the form, your benefit may be interrupted or discontinued.

In previous years, I was required to have this form notarized. Since the MTRS is only requiring the form to be signed by a witness—who can I use as a witness?

The witness can be ANYONE 18 years of age or older (spouse, sibling, neighbor, etc.). Please have your witness fill out their section in its entirety or the form will not be accepted.

Can I fax my Benefit Verification Form to the MTRS?

No—we require your original, witnessed signature to help ensure more secure and efficient processing.

Regarding the “Return by” date—does my Benefit Verification Form have to be postmarked or received by that date?

Received, so we encourage you not to wait until the last minute to return your form. To ensure proper delivery of your form, please use the pre-addressed reply envelope that we provide.

I misplaced the pre-addressed reply envelope. To what address must I return my form?

Please return your form to:

Massachusetts Teachers’ Retirement System

500 Rutherford Avenue, Suite 210

Charlestown, MA 02129-1628

I am a parent/guardian of a dependent child receiving survivor benefits, what do I do?

If you are the parent or guardian of dependent children who are receiving survivor benefits, you will receive—and must complete and return—a Benefit Verification form for each child (the child’s name will appear in Part 2).

Do benefit recipients that are permanent Massachusetts residents need to complete a Benefit Verification Form?

No. The Benefit Verification process is discontinued for permanent MA residents. A recent regulatory change ends the requirement that Massachusetts retirement systems conduct a biennial Benefit Verification (BV) process, provided the system utilizes a third-party death match service. The MTRS utilizes such a service and also receives comprehensive vital statistics from the Commonwealth of Massachusetts. Thus, going forward, the MTRS will only send BVFs to benefit recipients whose permanent address is out of state.

Please note: if your permanent address is in MA, but you have an active temporary address during the mailing period (late January), you will receive your 1099-R at your active temporary address but will not receive a BVF; nor will you be required to complete one.

Do benefit recipients residing OUTSIDE of Massachusetts need to complete a Benefit Verification Form?

Yes. If you maintain a permanent residence outside of Massachusetts, you will receive your 1099-R and Benefit Verification Forms together in the SAME ENVELOPE and you must complete and return your Benefit Verification Form as instructed.

Will the MTRS acknowledge receipt of my Benefit Verification Form?

Yes. After we receive and process your completed form, we will send an email confirmation, if we have an email on file or if you provided an email on your form. Otherwise, we will send you a postcard within four to six weeks.

The benefit recipient is deceased, or under guardianship or conservatorship or has assigned power of attorney to another person. What should we do?

If the person to whom the Benefit Verification Form is addressed is deceased, or under guardianship or conservatorship or has assigned power of attorney to another person, a survivor or the appropriate responsible person needs to complete and return the form. Please note:

- You do not need to complete anything on the front of the form.

- Please review the instructions in the shaded box on the back of the form, then check one of the two boxes to indicate the status of the Benefit Recipient.

- If the Benefit Recipient is deceased, please call our Contact Center at 617-679-6877 as soon as possible.

- As noted, please provide the requested information, attach any other documentation, complete the signature section and have the Witness Information section completed, and then return the form and any documents in the envelope provided.

If I live outside of the U.S., what do I need to do?

If living outside of the U.S., you are required to have your Benefit Verification Form notarized. Please make sure you sign and date the form in the presence of a notary. The notary needs to complete their section in its entirety. If you have further questions, please call our main office at 617-679-6877 or email us at GenInfo@trb.state.ma.us.

Can I access my Benefit Verification form online?

No—you will need to complete and return the original blue-and-yellow form that we send you. Your Benefit Verification form is not available online in order to prevent duplicate returns.

Approval process

Cost-of-living adjustments are granted to MTRS benefit recipients by vote of the Massachusetts Legislature. Every year, the Public Employee Retirement Administration Commission (PERAC) files with the Legislature a report detailing the increase or decrease in the Consumer Price Index (CPI). The Legislature then votes whether to grant a COLA based on the increase in the CPI or 3%, whichever is less.

Calculation

Currently, the retirement base on which a COLA is granted is $13,000. Accordingly, if the Legislature grants a 3% COLA effective July 1, a benefit recipient may have his or her allowance increased by a maximum of $390 per year, or $32.50 per month.

For your reference, the COLA for fiscal year 2025 was 3% on a base of $13,000, effective July 1, 2024. For fiscal year 2026, it was also 3% on a base of $13,000, effective July 1, 2025.

COLAs are cumulative: If they are granted, COLAs are added to your gross retirement allowance. For example, if your annual retirement allowance is $40,000 and the COLA is $390, your gross allowance becomes $40,390. With the next year’s COLA, your allowance increases to $40,780; the following year it is $41,170, and so on. In other words, that first $390 “stays” in your allowance over the years. So, if you retire on July 30 instead of June 30, you will not only “miss” that first COLA of $390 in your first year of retirement, but every year thereafter. Over the course of 20 years, that could result in $7,800 in “missed” COLAs; while this may not make enough of a difference for you to change your choice of retirement date, you should be aware of the effect this might have on your benefits.

Eligibility

| Recipient | When eligible to receive first COLA | To be eligible to receive the FY2026 COLA, effective July 1, 2025 |

|---|---|---|

| Retiree | After being retired for one full, July-through-June fiscal year | The retiree must have retired on or before June 30, 2024 |

| Survivor of Option C retiree | After the retiree has been retired for one full, July-through-June fiscal year | The Option C retiree must have retired on or before June 30, 2024 |

| Survivor of a member who died in active service | After one full, July-through-June fiscal year from the effective date of your survivor benefit | The member's date of death must have been on or before June 30, 2024 |

| Accidental death benefit recipient | After one full, July-through-June fiscal year from the effective date of your benefit | Your benefit must have begun on or before June 30, 2024 |

Historical notes

Prior to 1976, COLAs were automatic. The percentage was based on the previous year’s consumer price index (CPI) increase. In 1975, the Legislature repealed this formula, effective 1976. Beginning in 1981, the provisions of Proposition 2-1/2 required the state to fund all local government COLA costs. Prior to 1981, the state funded state and teacher retirees’ COLAs, while local governments were required to fund city, town and county COLAs.

From 1998 to 2011, the base remained at $12,000, for a maximum annual increase of $360. In November 2011, pursuant to Chapter 176 of the Acts of 2011, the base increased to $13,000 for a maximum annual increase of $390.

MTRS COLA history

| Year | Allowed percentage | Retirement benefit base | Maximum annual amount | Notes |

|---|---|---|---|---|

| 1971 | 6.00% | of $6,000.00 | $360.00 | |

| 1972 | 4.30% | of $6,000.00 | $258.00 | |

| 1973 | 3.30% | of $6,000.00 | $198.00 | |

| 1974 | 6.20% | of $6,000.00 | $372.00 | |

| 1975 | 11.00% | of $6,000.00 | $660.00 | |

| 1976 | 5.00% | of $6,000.00 | $300.00 | |

| 1977 | 5.00% | of $6,000.00 | $300.00 | |

| 1978 | 6.50% | of $6,000.00 | $390.00 | |

| 1979 | 5.00% | of $6,000.00 | $300.00 | |

| 1980 | 6.00% | of $6,000.00 | $360.00 | |

| 1981 | 3.00% | of $7,000.00 | $210.00 | |

| 1982 | 3.00% | of $7,000.00 | $210.00 | |

| 1983 | 3.00% | of $7,000.00 | $210.00 | |

| 1984 | 4.00% | of $7,000.00 | $280.00 | |

| 1985 | 4.00% | of $8,000.00 | $320.00 | |

| 1986 | 4.00% | of $9,000.00 | $360.00 | |

| 1987 | 3.00% | of $9,000.00 | $270.00 | |

| 1988 | 4.00% | of $9,000.00 | $360.00 | |

| 1989 | NO COLA | |||

| 1990 | NO COLA | |||

| 1991 | NO COLA | |||

| 1992 | 5.00% | of $9,000.00 | $450.00 | effective 01/01/1992 |

| 1993 | NO COLA | |||

| 1994 | 3.00% | of $9,000.00 | $270.00 | |

| 1995 | NO COLA | |||

| 1996 | 3.00% | of $9,000.00 | $270.00 | effective 11/01/1996 |

| 1997 | NO COLA | |||

| 1998 | 2.10% | of $12,000.00 | $252.00 | |

| 1999 | 3.00% | of $12,000.00 | $360.00 | |

| 2000 | 3.00% | of $12,000.00 | $360.00 | |

| 2001 | 3.00% | of $12,000.00 | $360.00 | |

| 2002 | 3.00% | of $12,000.00 | $360.00 | |

| 2003 | 3.00% | of $12,000.00 | $360.00 | |

| 2004 | 3.00% | of $12,000.00 | $360.00 | |

| 2005 | 3.00% | of $12,000.00 | $360.00 | |

| 2006 | 3.00% | of $12,000.00 | $360.00 | |

| 2007 | 3.00% | of $12,000.00 | $360.00 | |

| 2008 | 3.00% | of $12,000.00 | $360.00 | |

| 2009 | 3.00% | of $12,000.00 | $360.00 | |

| 2010 | 3.00% | of $12,000.00 | $360.00 | |

| 2011 | 3.00% | of $12,000.00 | $360.00 | |

| 2012 | 3.00% | of $13,000.00 | $390.00 | |

| 2013 | 3.00% | of $13,000.00 | $390.00 | |

| 2014 | 3.00% | of $13,000.00 | $390.00 | |

| 2015 | 3.00% | of $13,000.00 | $390.00 | |

| 2016 | 3.00% | of $13,000.00 | $390.00 | |

| 2017 | 3.00% | of $13,000.00 | $390.00 | |

| 2018 | 3.00% | of $13,000.00 | $390.00 | |

| 2019 | 3.00% | of $13,000.00 | $390.00 | Paid 08/30/2019, retroactive to 07/01/2019 |

| 2020 | 3.00% | of $13,000.00 | $390.00 | Paid 12/31/2020, retroactive to 07/01/2020 |

| 2021 | 3.00% | of $13,000.00 | $390.00 | Paid 7/30/2021 |

| 2022 | 5.00% | of $13,000.00 | $650.00 | Paid 8/31/2022 |

| 2023 | 3.00% | of $13,000.00 | $390.00 | Paid 8/31/2023 |

| 2024 | 3.00% | of $13,000.00 | $390.00 | Paid 7/31/2024 |

| 2025 | 3.00% | of $13,000.00 | $390.00 | Paid 7/31/2025 |

*Unless otherwise noted, all COLAs are effective on a fiscal year basis (e.g., the COLA listed as “2025,” above, is effective for the fiscal year beginning July 1, 2025).

Obtaining verification of your benefit income

During your retirement, you may need to provide verification of your MTRS benefit amount to a third party, for example, when applying for a loan, a rent or mortgage rebate, or nursing home or public housing. If you are requesting verification for Social Security purposes, please be sure to tell the MTRS representative this, as we will need to include additional information in your letter.