Dear School District Superintendents, Charter School and Education Collaborative Directors, Business Managers, Town Treasurers, Personnel Administrators and Payroll Officers,

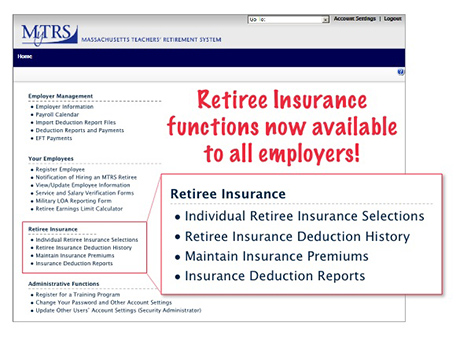

In October, we added Retiree Insurance functions to the employer self-service area in MyTRS, and asked a small number of districts to evaluate them as well as the related training materials. The results are in, and overall, the feedback couldn’t have been more positive and enthusiastic!

Accordingly, the Retiree Insurance functions are now available to ALL employers.

Now, all districts that do not participate in the GIC’s Retired Municipal Teachers (RMT) program can maintain their retirees’ insurance functions—in real-time—using MyTRS instead of our current form-based process.

What this means for district insurance coordinators

You can:

- View the details of your retirees’ and survivors’ coverage

- Set up, change and cancel individuals’ coverage—in real-time

- Verify that a retroactive coverage change triggered a “rebill” either to bill or refund the individual when our warrant runs

- View the insurance types and rates listed in our system

- Download four different insurance-related reports (these reports are updated monthly, one week after the monthly warrant close date):

- GASB45

- Insurance deduction report—in the existing format and by provider

- Insurance premium list

NOTE: Districts that currently participate in the GIC’s Retired Municipal Teacher (RMT) program may only download their GASB45 reports, which will not include their retirees’ insurance information. GIC-RMT districts do not have access to retiree insurance functions as these processes are handled for them by the GIC.

At this time, however, you cannot enter global rate changes. Please continue to submit global rate changes to us via our Group Rate Premium Change Form. Because of the nuances in processing global rate changes in MyTRS, we are currently restricting access to this function to MTRS staff. This may change in the future, but for now, this function will remain in-house.

Getting started

If you:

- already have access to MyTRS, please review the training materials (see below), sign in to MyTRS and begin using the new functions today!

- do not have access to MyTRS and would like to know who in your district is in charge of providing access, please e-mail us at empsup@trb.state.ma.us with the subject “SA Request” and we will provide you with the name of your district’s Security Administrator as appointed by your superintendent.

Training materials (also available on our website at MyTRS Guides)

- READ ME FIRST: What to know BEFORE making changes to retiree coverage (3pp)

- Processing retiree insurance deductions (13pp)

- Checking retiree insurance deduction history (3pp)

- Reviewing retiree deduction rates (2pp)

- Downloading retiree insurance reports (5pp)

FAQs

I recently submitted a change request to the MTRS and it has not yet been processed. Will the MTRS process it, or should I?

We will continue to process retiree insurance change forms sent to our insurance updates e-mail address as we work with insurance coordinators to transition everyone to the self-service functions. However, we expect that there will be delays in processing requests submitted to us via e-mail as our Employer Services staff will also be supporting employers as they learn how to use the new functions. We encourage employer representatives who do not yet have access to MyTRS to contact their district’s MyTRS Security Administrator to get access so that they may avoid unnecessary processing delays.

If you have any outstanding requests, we will process them as usual, in the order in which they were received. However, if you would like to process any of your outstanding requests, please do! You do not need to tell us that you are processing them; if, when we attempt to process your requests, we see that you have already changed the records, we will then verify your changes against your submitted requests, and confirm whether what you did online was correct, or, if not, what issues we identified.

What are the deadlines for submitting changes each month?

If you submit your changes:

- Directly in MyTRS: The deadline is any time before our monthly warrant processing date—generally, the 15th of each month (e.g., changes saved in MyTRS before our warrant processing date in April, will be reflected in the retiree’s payment for April, which the retiree will receive at the end of April). For monthly deadlines and other updates, please see the message area on the employer self-service homepage in MyTRS.

- On forms submitted to us via e-mail: The deadline is the first of the month before the month that the changes are to be reflected (e.g., changes to be reflected in the retiree’s payment for April must be submitted to us by March 1). As noted above, however, we expect that there will be delays in processing changes submitted via e-mail.

Brand new vs. existing retirees and survivors: Is the process for adding coverage different?

Yes—before you can add coverage for brand new retirees and survivors, the MTRS must first “enable” their insurance records in MyTRS (a quick and easy step for us). Accordingly, when you want to add coverage for a new retiree or newly qualified survivor, please send an e-mail to insuranceupdates@trb.state.ma.us with a subject line of Enable new retiree/survivor; in the body of the e-mail, indicate the individual’s name and any other details you want to include, and we will process your request as quickly as possible. (Note: We are working to eliminate this extra step in the future by automatically enabling future retirees’ insurance records after we have received their retirement applications.)